The US Cities with the Biggest Housing Bubbles - FINANCIAL-24

By Wolf Richter, Wolf Street

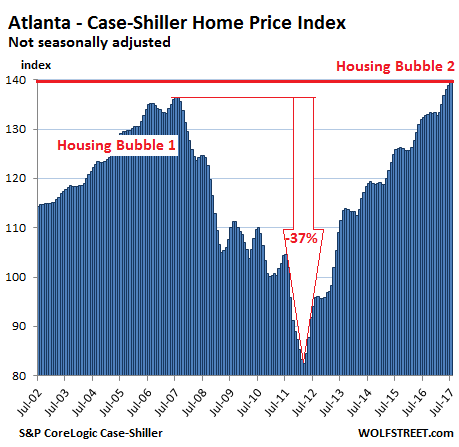

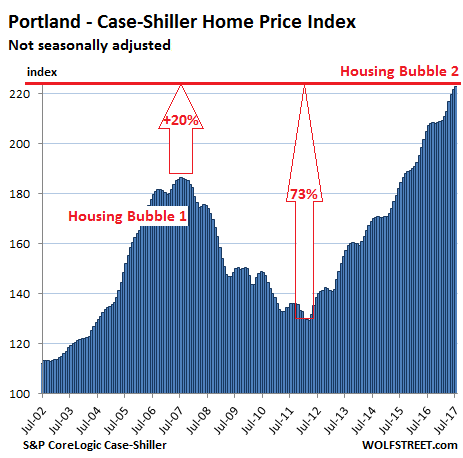

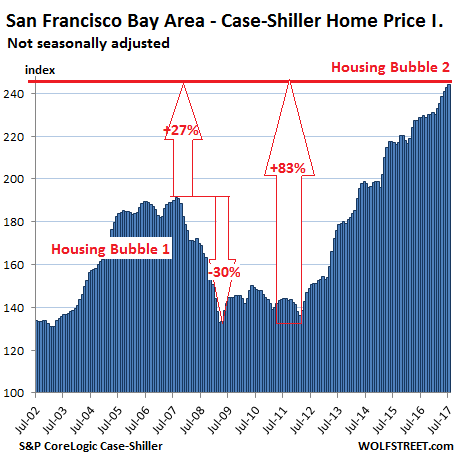

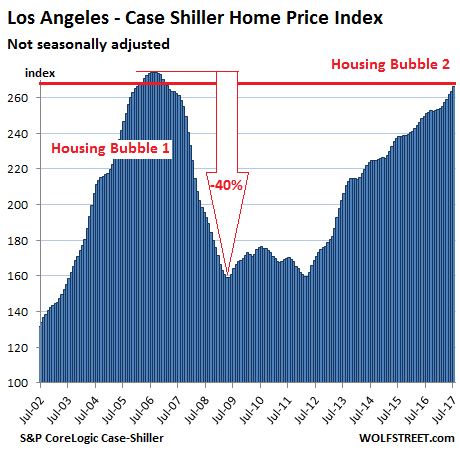

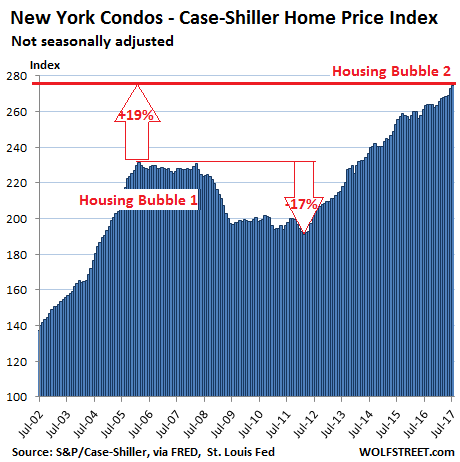

The term “housing bubble” to describe the housing market that peaked in 2006 and imploded with spectacular effects has been gradually fading out of use. The current theme is that years of asset price inflation have “healed” the housing market, and that the crazy peak of Housing Bubble 1 is now just some sort of normal base. Oh my…

The S&P CoreLogic Case-Shiller National Home Price Index for July was released today. The not-seasonally-adjusted index jumped 6% year-over-year, by far outrunning growth in wages and household incomes, which it has done for years. The index has surpassed by 5% the crazy peak (I mean, the normal base) in July 2006:

While real estate is subject to local dynamics, monetary policies have a massive impact, particularly in places where the money flows to, which creates local housing bubbles. If enough local bubbles balloon at the same time, it becomes a national housing bubble – as seen in the chart above.

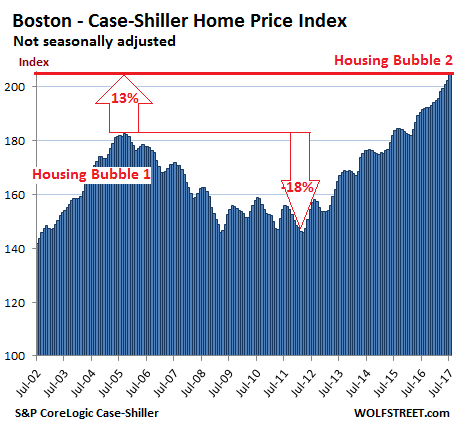

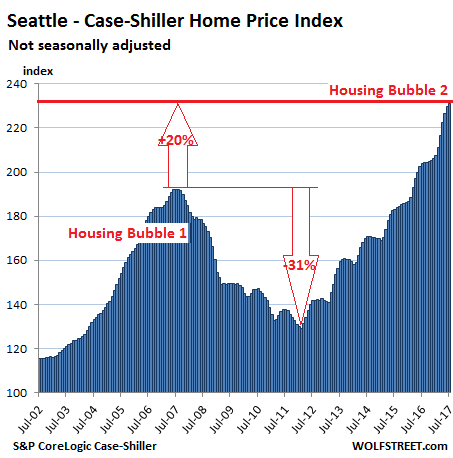

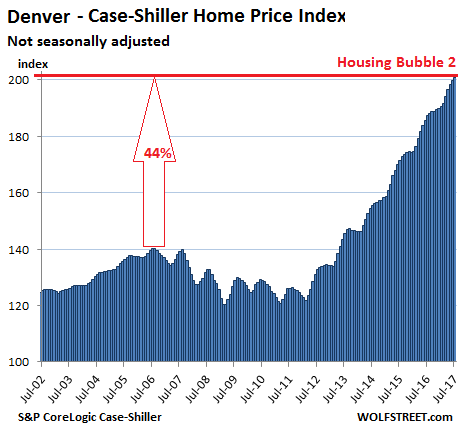

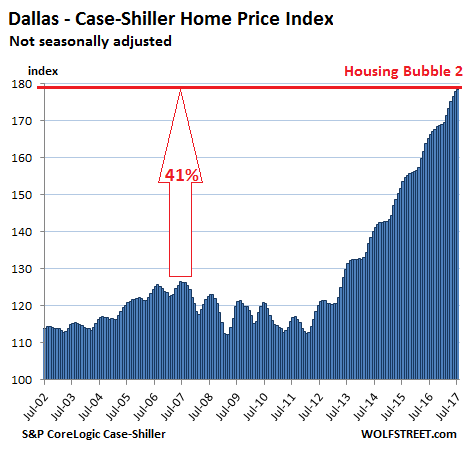

Below are the local housing bubbles of major metro areas in all their magnificent beauty:

These are the visual effects of asset price inflation. A home whose price increases by 50% in five years didn’t get 50% larger or nicer. Instead, the value of dollars with regards to assets has gotten crushed. QE and ZIRP produced no wage inflation, moderate consumer price inflation, but extraordinary asset price inflation.

These are the visual effects of asset price inflation. A home whose price increases by 50% in five years didn’t get 50% larger or nicer. Instead, the value of dollars with regards to assets has gotten crushed. QE and ZIRP produced no wage inflation, moderate consumer price inflation, but extraordinary asset price inflation.

0 Response to "The US Cities with the Biggest Housing Bubbles - FINANCIAL-24"

Post a Comment